See the updated schedule!

CLE Code 237959 for Can Am 2017

We have received the CLE code for attorney credits for this year’s Can Am.

It is: 237959

Dept Public Safety Press Conference

See below for a link to the press conference on the record numbers of drugs seized in MN this year:

Charges: Minn. medical marijuana execs illegally distributed oils Issues

http://www.mprnews.org/story/2017/02/06/minn-medical-marijuana-illegal-distribution-charges

Opioid Report

The Office of Minnesota Attorney General has released a report on the Opioid epidemic- Preventing and Addressing Prescription Drug Abuse.

Download it here: Opioid Report

NW HIDTA releases Marijuana Impact Report

The Northwest High Intensity Drug Trafficking Area team has released their report on the devastating effects of marijuana legalization in Washington and surrounding states. It echoes much of the Rocky Mountain HIDTA’s reports on the failed social experiment in those two states.

Read the details here: NWHIDTA Marijuana Impact Report Volume-1

Drug Policy Source Book (2012)

MSANI developed an information CD on drug policy which has been uploaded here:

Also:

DEA Slowed Enforcement?

Investigation: The DEA slowed enforcement w hile the opioid epidemic grew out of control

By Lenny Bernstein and Scott Higham October 22

UNNATURAL CAUSES SICK AND DYING IN SMALL-TOWN AMERICA: Since the turn of this century, rates have risen for whites in midlife, particularly women. In this series, The Washington Post is exploring this trend and the forces driving it. Related: Wholesalers sent pills to drugstores that fueled the opioid epidemic

A decade ago, the Drug Enforcement Administration launched an aggressive campaign to curb a rising opioid epidemic that was claiming thousands of American lives each year. The DEA began to target wholesale companies that distributed hundreds of millions of highly addictive pills to the corrupt pharmacies and pill mills that illegally sold the drugs for street use.

Leading the campaign was the agency’s Office of Diversion Control, whose investigators around the country began filing civil cases against the distributors, issuing orders to immediately suspend the flow of drugs and generating large fines.

But the industry fought back. Former DEA and Justice Department officials hired by drug companies began pressing for a softer approach. In early 2012, the deputy attorney general summoned the DEA’s diversion chief to an unusual meeting over a case against two major drug companies.

“That meeting was to chastise me for going after industry, and that’s all that meeting was about,” recalled Joseph T. Rannazzisi, who ran the diversion office for a decade before he was removed from his position and retired in 2015.

Rannazzisi vowed after that meeting to continue the campaign. But soon officials at DEA headquarters began delaying and blocking enforcement actions, and the number of cases plummeted, according to on-the-record interviews with five former agency supervisors and internal records obtained by The Washington Post.

The judge who reviews the DEA diversion office’s civil caseload noted the plunge.

“There can be little doubt that the level of administrative Diversion enforcement remains stunningly low for a national program,” Chief Administrative Law Judge John J. Mulrooney II wrote in a June 2014 quarterly report obtained under the Freedom of Information Act.

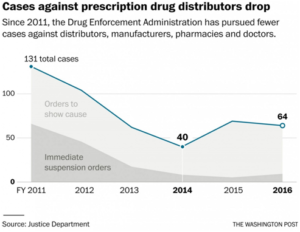

In fiscal 2011, civil case filings against distributors, manufacturers, pharmacies and doctors reached 131 before dropping to 40 in fiscal 2014, according to the Justice Department. The number of immediate suspension orders, the DEA’s strongest weapon of enforcement, dropped from 65 to nine during the same period.

“Things came to a grinding halt,” said Frank Younker, a DEA supervisor in the Cincinnati field office who retired in 2014 after 30 years with the agency. “I talked to my fellow supervisors, and we were all frustrated. It was ridiculous. I don’t know how many lives could have been saved if the process was done quicker.”

The slowdown began in 2013 after DEA lawyers started requiring a higher standard of proof before cases could move forward.

Top officials at the DEA and Justice declined to discuss the reasons behind the slowdown in the approval of enforcement cases. The DEA turned down requests by The Post to interview Mulrooney, acting DEA administrator Chuck Rosenberg, chief counsel Wendy H. Goggin and Rannazzisi’s replacement, Louis J. Milione.

The agency provided a statement from Rosenberg:

“We combat the opioid crisis in many ways: criminally, civilly, administratively, and through robust demand reduction efforts.

“We implemented new case intake and training procedures for our administrative cases, increased the number of enforcement teams focused on criminal and civil investigations, restarted a successful drug take back program, and improved outreach to — and education efforts with — our registrant community.

“We have legacy stuff we need to fix, but we now have good folks in place and are moving in the right direction.”

The Justice Department, which oversees the DEA, declined requests to interview Attorney General Loretta E. Lynch and Deputy Attorney General Sally Q. Yates.

The department issued a statement saying that the drop in diversion cases reflects a shift from crackdowns on “ubiquitous pill mills” toward a “small group” of doctors, pharmacists and companies that continues to violate the law.

Justice Department spokesman Peter Carr said diversion investigators are also increasingly using criminal procedures to force targets to surrender their licenses without administrative hearings.

“Although these reasons largely account for the decline in administrative case filings, the department remains committed to eliminating the problem of opioid abuse,” Carr said, pointing out that the diversion control chief had recently been elevated to a “top leadership post.”

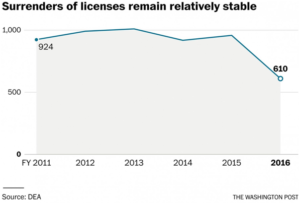

But Justice statistics show that surrenders of licenses have remained relatively constant since 2011 before dropping by more than a third in the last fiscal year. Carr could not say how many were tied to DEA enforcement actions. The former agency supervisors said the majority of surrenders do not involve DEA enforcement actions.

The epidemic began in the late 1990s after the introduction of the powerful, long-acting opioid OxyContin and an aggressive marketing campaign by the drug’s manufacturer, Purdue Pharma, to persuade doctors to prescribe it for all kinds of pain. A new philosophy of pain management resulted in a surge in demand and the U.S. addiction rate.

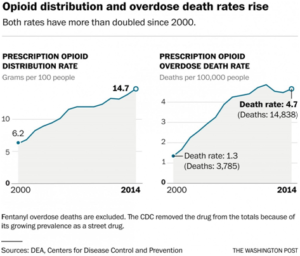

From 2000 to 2014, 165,000 people died of overdoses of prescription painkillers nationwide. The crisis has also fostered follow-on epidemics of heroin, which caused nearly 55,000 overdose deaths in the same period, and fentanyl, which has killed thousands more. The number of U.S. opioid prescriptions has risen from 112 million in 1992 to 249 million in 2015.

Several DEA officials on the front lines of the opioid war said they could not persuade headquarters to approve their cases at the peak of the epidemic. They said they confronted Clifford Lee Reeves II, a lawyer in charge of approving their cases, to no avail. Through a DEA spokesman, Reeves declined to comment for this report.

Jim Geldhof had been with the DEA for nearly four decades and was serving as the diversion program manager in the Detroit field office when Reeves took over at DEA headquarters in 2012.

“It was like he was on their side, not ours,” said Geldhof, who retired in January. “I don’t know what his motive was, but we had people dying. You’d think he’d be more aggressive. We were in the throes of a major pill epidemic.”

In the field, Younker and other DEA supervisors said they grew to distrust Reeves and became suspicious about what was taking place at headquarters.

“We all had a feeling that someone put him there to purposely stonewall these cases,” Younker said.

Kathy Chaney, who served as the DEA’s group supervisor in Columbus, Ohio, saw the problem play out firsthand. She was responsible for 35 counties in Ohio and had overseen the agency’s efforts to curb prescription painkiller abuse in cities such as Chillicothe and Portsmouth, both at ground zero of the opioid crisis.

She said one of her cases against a distributor languished for years without action. The experience was particularly difficult, Chaney said, because she had been meeting with parents of children who had died of overdoses of oxycodone and other painkillers.

“We got so frustrated, I finally told my group, ‘We’re not going to send any cases up to headquarters,’ ” said Chaney, who retired in 2013. “In 25 years, I had never seen anything like it. It was one of the reasons I left. Morale was terrible. I couldn’t get anything done. It was almost like being invisible.”

***

In 2004, the leaders of the DEA’s diversion office became alarmed by the rising number of overdose deaths amid a growing supply of prescription painkillers. Online pharmacies were flourishing, making it easy to buy powerful painkillers such as oxycodone and hydrocodone. The death toll had hit 8,577, a 15 percent jump in one year.

Pain-management clinics began popping up around the country. DEA diversion investigators soon realized that they were playing a real-life game of Whac-a-Mole. As soon as they shut down one facility, another would appear.

“People were dying,” said William J. Walker, a 31-year DEA veteran who headed the diversion office in 2004 and 2005.

Walker set up tactical units around the country to investigate doctors, pharmacists, distributors and manufacturers.

“We had a multilayered threat, and there was a tremendous sense of urgency,” he said. “I turned up the heat on the workforce, and we started getting after it.”

Toward the end of 2005, Walker, a brigadier general in the National Guard, was called up for active duty and left the office. Taking his place was his top deputy, Joseph Rannazzisi, a street-smart New Yorker who held degrees in pharmacy and law. He had begun his career as a DEA street agent and then a supervisor in Detroit before working his way to the top of the diversion office at the agency’s headquarters in Arlington, Va.

Rannazzisi decided to focus on the source of the pills: the wholesale distributors of pharmaceuticals.

Drugs are manufactured by high-profile corporations such as Purdue Pharma. They rely on a lesser-known network of distributors, some of which are also multinational corporations. The distributors serve as middlemen, sending billions of doses of opioid pain pills to pharmacists, hospitals, nursing homes and pain clinics. The U.S. prescription opioid market generates $10 billion in annual sales.

There are thousands of distributors among the 1.6 million people and companies that hold DEA licenses to dispense drugs, but three of them — McKesson, AmerisourceBergen and Cardinal Health — account for 85 percent of the drug shipments in the United States. These companies, which together collect about $400 billion in annual revenue, supply the corner pharmacist as well as giant medical centers.

For years, the DEA had taken a hands-off approach to the prescription drugs flowing out of the distributors. The companies had been reporting their drug sales inconsistently or not at all. They had been largely left alone as the DEA focused on doctors and pharmacies.

“The distributors had been ignored for years and years and years,” John J. Coleman, the third-ranking administrator at the DEA in the mid-1990s, said in a recent interview.

In 2005, the Office of Diversion Control, under Rannazzisi, launched its “Distributor Initiative” and briefed 76 companies about it. The new campaign pitted the DEA against an industry with close ties to lobbyists, lawyers and politicians in Washington.

On Sept. 27, 2006, the diversion office sent a letter to distributors across the country, reminding them that they were required by law to ensure that their drugs were not being diverted to the black market.

“Given the extent of prescription drug abuse in the United States, along with the dangerous and potentially lethal consequences of such abuse, even just one distributor that uses its DEA registration to facilitate diversion can cause enormous harm,” Rannazzisi wrote in the letter.

Five months later, D. Linden Barber, then-associate chief counsel for the DEA diversion office, wrote to DEA supervisors across the country, telling them to be vigilant. Abuse of prescription drugs, he said, had become “greater than the abuse of cocaine, heroin and methamphetamine.”

Under Rannazzisi’s initiative, distributors would have to monitor their sales in real time, withhold drug shipments if they detected suspicious activity and report those red flags to the DEA.

The diversion office deployed two weapons to ensure compliance. The first was an “order to show cause,” which permits investigators to begin a process to stop drug shipments from warehouses. The second was an “immediate suspension order,” which allows the DEA to instantly freeze shipments of narcotics from facilities where an “imminent threat” to public health exists. The immediate suspension order was especially dreaded by the distributors.

Younker, the former DEA supervisor in Cincinnati, said the agency had no other choice.

“The distributors could have stopped what was going on, but they didn’t,” he said. “They were doing the bare minimum. Why would you want to cut off a customer that’s paying you $2 million a year? They have sales reps and sales quotas and bonus structures and employees of the month. Everyone was making a lot of money.”

The DEA diversion office started small. Investigators targeted Southwood Pharmaceuticals, a mom-and-pop distributor in Lake Forest, Calif., where shipments of hydrocodone had skyrocketed over nine months in 2005, from 7,000 doses per month to 3 million. Southwood eventually lost its license to dispense controlled substances.

In 2007, the DEA raised its sights, bringing an enforcement case against McKesson — now the nation’s largest drug distributor and the fifth-largest corporation in the country. The DEA accused the company of failing to report hundreds of suspicious orders from online pharmacies.

“As a result, millions of dosage units of controlled substances were diverted from legitimate channels of distribution,” a Justice Department news release said in 2008. Without admitting liability, McKesson eventually settled the case, agreeing to pay a $13 million fine.

That same year, the diversion office filed a case against Cardinal Health, another member of the Big Three wholesalers. DEA investigators alleged that the company was sending millions of doses of painkillers to online and retail pharmacies without alerting investigators to an obvious sign of illegal diversion.

Cardinal settled the allegations in 2008, paying a $34 million fine without acknowledging wrongdoing and promising to improve its monitoring of suspicious orders. Cardinal’s chief executive at the time said the company had spent $20 million to control diversion and took its responsibility “very seriously.”

Still, the painkiller crisis raged. In 2008, 13,149 people died of opioid overdoses.

The next year, a federal law made it illegal to distribute controlled substances online and required doctors to see their patients face-to-face before writing prescriptions.

By now, the DEA’s campaign was broad and deep. Mulrooney, the agency’s chief law judge, noted in an internal report that the agency had filed 115 charging documents in 2010, including 52 immediate suspension orders.

“Progress,” the chief judge wrote, noting that all pending cases were scheduled for hearings. “This has not been true for as long as anyone here can remember.”

In late 2011, Rannazzisi’s office filed warrants to yet again inspect the records of a Cardinal warehouse. Investigators alleged that the company was overlooking escalating oxycodone orders from pharmacies in Florida. The DEA was also targeting four drugstores supplied by Cardinal in the state, including two CVS pharmacies.

Rannazzisi’s office obtained an internal Cardinal email from 2010 showing that the company’s own investigator had warned against selling narcotics to Gulf Coast Medical Pharmacy, an independent drugstore in Fort Myers, Fla., citing suspicions that the pills were winding up on the street.

Despite the warning, Cardinal hadn’t notified the DEA or cut off the supply of drugs.

Instead, the company shipped increasing quantities of pain pills to Gulf Coast. In 2011 alone, Cardinal sent more than 2 million doses of oxycodone to Gulf Coast. The wholesaler typically shipped 65,000 doses annually to comparable pharmacies.

“I had the case of my dreams,” Rannazzisi said.

About Thanksgiving in 2011, Rannazzisi said that he received an unexpected phone call.

It was from James H. Dinan, then-chief of the Organized Crime Drug Enforcement Task Forces program at the Justice Department. Dinan worked with then-Deputy Attorney General James M. Cole, the second-most-powerful Justice Department official after Attorney General Eric H. Holder Jr.

Rannazzisi said Dinan told him: “We’re getting calls from attorneys, former Justice people, that are saying you guys are doing some enforcement action.”

Rannazzisi said he told Dinan that warrants for Cardinal records had already been served.

Among the attorneys representing Cardinal at the time were two former deputy attorneys general, Jamie S. Gorelick, who served in the Clinton administration, and Craig S. Morford, who served in the George W. Bush administration. Both contacted the DEA, records show.

Gorelick did not respond to requests for an interview. Morford declined to comment. Instead, Cardinal referred questions to Barber, the former DEA associate chief counsel in charge of diversion litigation, who joined the law firm Quarles & Brady and is now representing distributors.

Barber told The Post that there was nothing unusual about Morford contacting the agency.

“It was not anything other than ‘we’d like to sit down and have a discussion at an early stage of the investigation,’ ” Barber said.

On Feb. 1, 2012, as Rannazzisi was preparing to sign off on immediate suspension orders against Cardinal and CVS, he said he received another call from Dinan.

Rannazzisi said Dinan told him that Cole, the deputy attorney general, known in the department as the “DAG,” was demanding a briefing before the suspension orders were executed.

The next morning, at 1:36 a.m., Dinan followed up with an email.

“Please call me in the morning,” he wrote, according to Rannazzisi. “I want to make double sure nothing unreversible happens before the DAG is briefed as we talked about at Thanksgiving.”

That morning, Rannazzisi went to the Justice Department in Washington to meet with a number of officials, including Cole; Dinan; Goggin, the DEA’s top lawyer; and Stuart M. Goldberg, Cole’s chief of staff.

Rannazzisi said Goldberg did most of the talking.

“He asked me a question about what my goals were in this case, and why I was going after these corporations,” Rannazzisi said. “I said, ‘Before I answer that, I’ve got to ask you: I’ve done hundreds of these cases, and I’ve never been called over to the Justice Department to explain myself. I’m just curious why this case is so important.’ ”

Rannazzisi said Cole interrupted.

“Because I’m the deputy attorney general of the United States, and I want to know about it,” he recalled Cole saying.

“Then I say, ‘Well, that doesn’t really answer the question,’ ” Rannazzisi said.

The meeting went downhill from there.

“It spiraled out of control,” Rannazzisi said. “It got very adversarial.”

Cole, who is now a partner at the Washington law firm Sidley Austin, disputed Rannazzisi’s characterization of the meeting.

“My conversation with Mr. Rannazzisi was simply to confirm whether or not he had refused to meet with Cardinal regarding a potential DEA action and, if so, share my view that it made good sense to listen to what Cardinal had to say,” Cole said in a statement.

“Hearing what Cardinal had to say could inform DEA of facts they may not have known. I did not tell Mr. Rannazzisi how to come out on the Cardinal matter and certainly did not discourage him from going after any company in violation of any statutes or regulations,” he said.

Dinan, now the principal assistant U.S. attorney for the District of Columbia, declined to comment through a spokesman. Goldberg and Holder did not respond to requests for an interview.

Rannazzisi said he left the meeting undeterred. The same day, his office filed the suspension order against Cardinal, and two days later, DEA investigators shut down the two CVS pharmacies. A week later, DEA officials said in court documents that Cardinal’s activities constituted “an imminent danger to the public health or safety.”

As the cases were pending, Goggin wrote to Rannazzisi to inform him that CVS was attempting to go around the agency by appealing to the office of the deputy attorney general, known as ODAG.

“CVS lawyers (who used to work at DOJ) are trying to do an end run with ODAG,” Goggin wrote, according to Rannazzisi. “They want (1) to get the administrator to hold off issuing a final order until we are able (presumably) to try and work out a settlement.”

In his statement, Cole said, “I do not recall having any involvement with CVS matters while at DOJ.”

Final orders make cases public because the decisions are published in the Federal Register. A final order was issued against CVS, which ultimately paid a $22 million fine.

In 2012, Cardinal also reached a settlement. A company spokesman recently told The Post that Cardinal uses state-of-the-art techniques, including advanced analytics, to combat diversion.

To date, the company has not been fined. A federal prosecutor and company officials said negotiations are continuing.

***

In December 2012, a new lawyer filled the position in charge of approving cases brought by the DEA’s diversion office. A career employee of the Justice Department, Clifford Reeves had worked on the case against CVS. At first, diversion investigators were encouraged by the arrival of an experienced lawyer.

But soon, complaints arose in some of the DEA’s field offices around the country. Under Reeves, DEA attorneys began demanding additional evidence before investigators could take action.

“After Reeves arrived, everything became confrontational,” Geldhof, the retired DEA diversion manager in Detroit, recalled in a recent interview. “There were a lot of roadblocks all the time. Everything was an issue.”

Before Reeves’s arrival, Geldhof said, investigators had to demonstrate that they had amassed “a preponderance of evidence” before moving forward with enforcement cases, which are administrative, not criminal. Under Reeves, Geldhof said, investigators had to establish that their evidence was “beyond a reasonable doubt,” a much higher standard used in criminal cases.

Geldhof said he repeatedly confronted Reeves about the languishing cases.

“I said, ‘Lee, what’s going on?’ ” Geldhof said.

He said Reeves simply told him about the new higher standard.

Barbara Heath, a DEA program manager in Atlanta, said she and her investigators were frustrated by the new policy in Washington.

“It was the most significant change in my 20 years at the DEA,” said Heath, who oversaw the agency’s diversion efforts in Georgia, the Carolinas and Tennessee from 2006 until her retirement in December. “It got to the point where they wanted the same evidence as criminal prosecutions. It was very difficult to prove intent.”

In Washington, Mulrooney, the chief DEA judge, was documenting the falling caseload. In a June 24, 2013, quarterly report, Mulrooney wrote that there was “a significant drop” in the number of “orders to show cause.” Four months later, he noted “a free fall in the numbers of charging documents.” For the first time since records had been kept, he noted, no charging documents had been filed for an entire month.

Younker, the retired DEA supervisor in Cincinnati, said he, too, called Reeves to complain.

“Look, these cases are lingering here, they’re down in your shop for six to 12 months,” Younker recalled telling Reeves. “They’re sending drugs out and people are dying, and this is like the emperor has no clothes on.”

Younker said Reeves replied: “Who’s the emperor?”

“I said, ‘You’re the emperor. You can’t sit on these things like this.’ ”

Seeing what was happening in the field, Rannazzisi said he became furious with Reeves.

“At one point, I said: ‘I’ve lost all faith in the counsel, and you’ve become a hindrance and not a help, and all these people are dying,’ ” Rannazzisi said.

Chaney, the former DEA supervisor in Columbus, said her office in 2011 began investigating an Ohio distributor that sent tens of millions of pain pills to doctors and pharmacies in Florida over three to four years.

Chaney said there was no reason to ship that many pills to Florida from Ohio, because the company already had a distribution facility in Florida. The DEA also had previously taken action against some of the doctors who were writing prescriptions for opioids filled by the Florida pharmacies.

“It was a righteous case,” she said.

But the lawyers at DEA headquarters disagreed. The original DEA attorney assigned to the case was removed and replaced by a lawyer who stalled the case at every turn, Chaney said.

“It was never enough,” she said. “We could never satisfy them.”

Chaney declined to identify the company because no legal action was taken.

At the end of 2013, she retired from the DEA.

“We were all very dedicated, and we were all deeply disappointed that the program was being manipulated this way,” she said.

Chaney said she had joined the DEA because of a personal loss: Her mother became addicted to Percocet after a car accident and died of an accidental overdose.

“That’s the reason I got into this work,” she said. “To see this happening, it makes me want to cry.”

In Washington, Mulrooney was becoming increasingly frustrated, his quarterly reports show. In a June 24, 2014, report, the judge wrote that the DEA’s legal office had filed only seven show-cause orders and one immediate suspension order in the previous three months.

“These numbers continue to reflect an alarmingly low rate of Agency Diversion enforcement activity on a national level relative to historical data,” Mulrooney wrote.

He noted that the drop in cases coincided with “a leadership transition” in the legal office. He wrote that he couldn’t determine who was to blame — the field offices or the lawyers at headquarters. Mulrooney divided the operating budget of the diversion office by the number of cases that were being approved. He found that each case was costing taxpayers nearly $11 million.

“Assuming also that opioid-

related deaths remain at over 20,000 per year (2010-2011 levels), this would mean that the Agency is on course to institute one administrative enforcement action for every 625 fatalities,” he wrote.

Three months later, Mulrooney reported that the diversion caseload was so low, his judges had little to do. He began permitting them to hear cases from other federal agencies, including the Bureau of Prisons and the Treasury Department.

In the summer of 2014, Rannazzisi said that he received an unusual request. To foster better relations with industry, the Justice Department wanted to meet with senior representatives of drug distributors and pharmacy chains.

Rannazzisi said he was appalled. Some of the companies were either under investigation or in the midst of settlement negotiations with the DEA diversion office, he said.

But Rannazzisi said that he objected and that the meeting did not take place.

***

That summer, lobbying by the pharmaceutical industry intensified on Capitol Hill. Several members of Congress, led by Reps. Tom Marino (R-Pa.) and Marsha Blackburn (R-Tenn.), were proposing a measure that critics said would undercut the DEA’s ability to hold drug distributors accountable.

Four major players lobbied heavily in favor of the legislation, called the Ensuring Patient Access and Effective Drug Enforcement Act. Together, McKesson, AmerisourceBergen, Cardinal and the distributors’ association, the Healthcare Distribution Alliance, spent $13 million lobbying House and Senate members and their staffs on the legislation and other issues between 2014 and 2016, according a Post analysis of lobbying records.

In July 2014, Rannazzisi was asked to explain his opposition to the bill in a conference call with congressional staffers.

“I said, ‘This bill passes the way it’s written we won’t be able to get immediate suspension orders, we won’t be able to stop the hemorrhaging of these drugs out of these bad pharmacies and these bad corporations,’ ” Rannazzisi recalled telling them. “ ‘What you’re doing is filing a bill that will protect defendants in our cases.’ ”

His remarks enraged Marino, the chairman of the House Judiciary subcommittee on regulatory reform.

In a Sept. 18, 2014, congressional hearing, Marino tore into then-DEA Administrator Michele Leonhart, Rannazzisi’s boss. By then, the legislation had passed the House; the bill was about to be introduced in the Senate.

“It is my understanding that Joe Rannazzisi, a senior DEA official, has publicly accused we sponsors of the bill of, quote, ‘supporting criminals,’ unquote,” Marino said. “This offends me immensely.”

Marino told Leonhart that Congress was sending the DEA a message: “You should take a serious look at your regulatory culture and seek collaboration with legitimate companies that want to do the right thing.”

Marino mentioned Holder’s desire to meet with representatives of the pharmaceutical industry. At a hearing, Marino said he was “disappointed that DOJ staff has not made this a priority.”

Seven days later, Marino and Blackburn, who represent districts in states that have been hit hard by the opioid epidemic, demanded that the Justice Department’s inspector general investigate Rannazzisi’s remarks. They said he had tried to “intimidate” members of Congress. An investigation was launched. Rannazzisi was replaced in August 2015 and retired last October.

“That led to his undoing,” said Matthew Murphy, a DEA official who worked with Rannazzisi in the diversion office. Rannazzisi had “very, very strong views” on what was happening on the street, Murphy said. “He wasn’t going to change his opinion because of some heat.”

Marino said the conflict boils down to one person — Rannazzisi.

“We had a situation where it was just out of control because of [Rannazzisi],” Marino said. “. . . His only mission was to get big fines. He didn’t want to [do] anything but put another notch in his belt.”

The legislation passed in 2016. It raises the standard for the diversion office to obtain an immediate suspension order. Now the DEA must show an “immediate” rather than an “imminent” threat to the public, a nearly impossible burden to meet against distributors, according to former DEA supervisors and other critics. They said the new law gives the industry something it has desperately sought: protection from having its drugs locked up with little notice.

DEA officials, who declined to speak on the record, said the agency retains its power to issue immediate suspension orders under the new law.

Four months after Rannazzisi left, representatives from drug distributors and pharmacy chains got the meeting they had long wanted with key government officials, including Rosenberg, the acting DEA administrator, and Milione, Rannazzisi’s replacement.

Afterward, the DEA issued a news release declaring that it had established a new relationship with the companies.

“The pharmaceutical industry has a vital role on the front lines of preventing drug misuse and abuse across America, as do we,” Rosenberg said in the release, “and we plan to work closely with them.”

The new relationship had been in the making for years.

“One longstanding Congressional criticism of DEA’s diversion control division has been a lack of communication with its registrants,” Carr, the Justice Department spokesman, said in the recent statement. “Upon his arrival at DEA in May 2015, in response to these concerns, Acting Administrator Rosenberg made it a priority to improve communication with registrants and strengthen partnerships with the regulated industry.”

John M. Gray, president and chief executive of the Healthcare Distribution Alliance, the wholesalers’ trade association, praised the new approach.

“HDA is pleased with the willingness of the new leadership at the DEA to meet with and engage registrants, and is encouraged by the Administration’s desire to ‘reset the relationship’ with our industry,’ ” Gray said in a recent statement to The Post.

Rannazzisi said he views the new relationship as a surrender to industry.

“This idea that they’re going to say, ‘I’m sorry I violated the law, give me another chance and I’ll make it right,’ without having some type of punishment, to me is outrageous,” he said. “Every time I talked to a parent who lost a kid, I’m pretty sure they didn’t want me to say, ‘Oh, give them another chance because corporate America needs another chance.’ ”

Steven Rich, David S. Fallis, Alice Crites and Josephine Peterson contributed to this report. Peterson is attached to The Post’s investigative unit through a program at American University.

Washington Post Article on DEA and Opioids

How drugs intended for patients ended up in the hands of illegal users: ‘No one was doing their job’

By Lenny Bernstein, David S. Fallis and Scott Higham October 22

For 10 years, the government waged a behind-the-scenes war against pharmaceutical companies that hardly anyone knows: wholesale distributors of prescription narcotics that ship drugs from manufacturers to consumers.

The Drug Enforcement Administration targeted these middlemen for a simple reason. If the agency could force the companies to police their own drug shipments, it could keep millions of pills out of the hands of abusers and dealers. That would be much more effective than fighting “diversion” of legal painkillers at each drugstore and pain clinic.

Many companies held back drugs and alerted the DEA to signs of illegal activity, as required by law. But others did not.

Collectively, 13 companies identified by The Washington Post knew or should have known that hundreds of millions of pills were ending up on the black market, according to court records, DEA documents and legal settlements in administrative cases, many of which are being reported here for the first time. Even when they were alerted to suspicious pain clinics or pharmacies by the DEA and their own employees, some distributors ignored the warnings and continued to send drugs.

“Through the whole supply chain, I would venture to say no one was doing their job,” said Joseph T. Rannazzisi, former head of the DEA’s Office of Diversion Control, who led the effort against distributors from 2005 until shortly before his retirement in 2015. “And because no one was doing their job, it just perpetuated the problem. Corporate America let their profits get in the way of public health.”

A review of the DEA’s campaign against distributors reveals the extent of the companies’ role in the diversion of opioids. It shows how drugs intended for millions of legitimate pain patients ended up feeding illegal users’ appetites for prescription narcotics. And it helps explain why there has been little progress in the U.S. opioid epidemic, despite the efforts of public-health and enforcement agencies to stop it.

At the peak of the crisis, the DEA retreated from the battle. A Post investigation published Sunday revealed that beginning in 2013, some officials at DEA headquarters began to block and delay enforcement actions against wholesale drug distributors and others, frustrating investigators in the field.

Several former DEA officials told The Post that the shift in approach undercut the cases against some of these distributors, who were ignoring signs that their customers were ordering suspicious quantities of narcotics.

“We could not get these cases through headquarters,” said Frank Younker, a DEA supervisor in the Cincinnati field office who retired in 2014 after a 30-year career. “We were trying to shut off the flow, and we just couldn’t do it.”

The 13 companies include Fortune 25 giants McKesson, Cardinal Health and AmerisourceBergen, which together control about 85 percent of all pharmaceutical distribution in the United States. They also include regional wholesalers such as Miami-Luken and KeySource Medical, both based in Ohio, as well as Walgreens, the nation’s largest retail drugstore chain. Many of the distributors are tiny operations with just a few employees.

It is not clear how many other cases exist. Because the DEA handles its enforcement actions administratively, few details surface unless the agency or the company discloses them, or if one side appeals in civil court.

The DEA declined to disclose how many enforcement actions it has brought against distributors, requiring a Freedom of Information Act request that The Post filed in April. The request is pending. The DEA also would not make any officials available to discuss this article, but it provided a statement from acting administrator Chuck Rosenberg defending the agency’s enforcement actions.

“We now have good folks in place and are moving in the right direction,” he said.

Some of the 13 companies have fought the DEA’s enforcement efforts in court and in hearings before the agency’s administrative law judges. Except in two pending cases, all have lost or settled. Using its civil authority, the DEA stopped the flow of narcotics from some company warehouses, and U.S. attorneys levied fines totaling more than $286 million.

Most of the 13 wholesalers involved in these cases declined to be interviewed. In court filings and congressional testimony, they said they have developed large and sophisticated systems to help prevent drug diversion. They have complained that it is difficult to police the activities of far-flung drug dispensers and have noted that drugs could not be sold to illegal users without prescriptions written by corrupt doctors. They also criticized the DEA’s past approach to the problem as punitive and its rules as vague and confusing.

But the problem is clearly ongoing. Prescription narcotics cause more overdose deaths every year than any street drug, including heroin. The painkiller epidemic has taken 165,000 lives since the turn of the century, with the number of deaths soaring from 3,785 in 2000 to 14,838 in 2014.

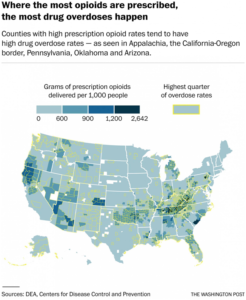

Opioid overdoses, mainly from prescription drugs, are also the leading cause of the recent unexpected rise in the mortality rate of middle-aged white Americans, particularly women in rural areas, after decades of steady decline.

But it is impossible to estimate how much of the opioid supply is siphoned away to illicit use.

“No one knows, because it’s impossible to track what happens to an individual prescription once it leaves the pharmacist,” said Susan Awad, director of advocacy and government relations for the American Society of Addiction Medicine.

One of the first wholesalers targeted by the DEA under its “Distributor Initiative” was Southwood Pharmaceuticals, a small company based in Lake Forest, Calif., that sent controlled substances to Internet pharmacies. Because these online businesses typically allowed people to obtain drugs without being seen by a doctor, they were ripe for abuse.

In 2005, for example, Southwood supplied one Florida online drugstore, Medipharm-Rx, with 8.6 million doses of hydrocodone — the opioid found in Vicodin and Lortab, according to the DEA.

But Southwood failed to file a single suspicious order report, even after the DEA warned the company in July 2006 about the growth in the volume of its shipments. The DEA had seen the trend in its own monitoring of drug-sales data.

“Even after being advised by agency officials that its internet pharmacy customers were likely engaged in illegal activity, [Southwood] failed miserably to conduct adequate due diligence,” Michele Leonhart, then the DEA’s deputy administrator, wrote in a 2007 decision to revoke the company’s license to distribute narcotics.

“The direct and foreseeable consequence of the manner in which [Southwood] conducted its due diligence program was the likely diversion of millions of dosage units of hydrocodone,” Leonhart wrote, adding that the company had reason to know that the 44 million doses of hydrocodone it distributed were probably being diverted.

That amount would provide a 30-day supply of narcotics for everyone in the city of Dallas, according to Express Scripts, a pharmacy benefit management company.

Southwood got out of the business of selling controlled substances and six years later lost its pharmacy license in California.

The company’s president, John Sempre, recently told The Post that the company did not understand at first that it was supplying Internet pharmacies. He said it is very difficult for companies to monitor the sales of faraway retailers.

“If companies like McKesson can’t control it, what does that tell you?” Sempre asked.

In 2008, McKesson, the nation’s largest drug distributor, settled a case that accused three of its U.S. warehouses of failing to report hundreds of suspicious orders from Internet pharmacies. “As a result, millions of doses of controlled substances were diverted from legitimate channels of distribution,” the Justice Department said in a news release. The company paid a $13 million fine to U.S. attorney’s offices in Florida, Maryland, Colorado, Texas, Utah and California.

“By failing to report suspicious orders for controlled substances that it received from rogue Internet pharmacies, the McKesson Corporation fueled the explosive prescription drug abuse problem we have in this country,” Leonhart, then the acting DEA administrator, said in a statement at the time.

Seven years later, after being caught up in a second diversion case, McKesson agreed to pay a $150 million fine and accepted license suspensions at four warehouses, according to a company filing with the Securities and Exchange Commission. No other details of that case have become public, and both the company and the DEA declined to discuss it.

A McKesson spokeswoman said in a statement to The Post, “We welcome the ongoing dialogue with the DEA aimed at developing effective controlled substances monitoring programs and successfully mitigating prescription drug abuse and diversion.”

AmerisourceBergen, another member of the so-called Big Three distributors, lost its license to send controlled substances from an Orlando warehouse on April 24, 2007, amid allegations that it was not controlling shipments of hydrocodone to Internet pharmacies. The facility was back in business by August of that year and did not pay a fine, according to a company spokeswoman.

Few details of the case have surfaced.

Cardinal, the third member of the Big Three, paid a $34 million fine in 2008 after seven of its warehouses across the country filled thousands of suspicious orders from Internet pharmacies without reporting them, despite an earlier warning from the DEA, according to a Justice Department news release.

On Oct. 5, 2010, when Cardinal investigator Vincent Moellering visited Gulf Coast Medical Pharmacy, a drugstore in Fort Myers, Fla., he found evidence of diversion everywhere, records show, including suspicious customers who came in groups to fill their prescriptions.

The pharmacy’s owner told Moellering that he could sell even more narcotics if Cardinal would supply them, according to Moellering’s report, which the DEA introduced in a court proceeding.

Moellering labeled the drugstore “high risk” and wrote: “I am not convinced that the owner is being forthright pertaining to his customers’ origin or residence. I have requested permission to contact DEA to resolve this issue.”

But Cardinal didn’t notify the agency or cut off Gulf Coast’s drug supply, the DEA contends. Instead, the shipments kept going out. In 2011 alone, Cardinal sent more than 2 million doses of oxycodone to Gulf Coast. Cardinal typically shipped 65,000 doses of the opioid annually to comparable pharmacies, the DEA said.

Even as Cardinal was increasing its shipments to Gulf Coast, another wholesale drug distributor, H.D. Smith, was cutting off its supply of painkillers to the pharmacy. Smith took action after one of its compliance officers visited Gulf Coast and found “impaired and lethargic” customers “with glassy eyes” in November 2010, a few weeks after Moellering’s visit, court records show.

The Smith inspector learned that the pharmacy filled 300 prescriptions a day, nearly half for controlled substances. Smith considered anything over 20 percent to be a red flag.

Gulf Coast owner Jeffrey R. Green and manager Karen S. Hebble sometimes waited after hours to sell narcotics, even without a pharmacist present, court records show.

Drug dealers said they brought groups of fake patients — known in the trade as “spuds” or “skidoodies” — to Gulf Coast to fill bogus prescriptions obtained from cooperating prescribers, court records state. They always paid cash.

One drug dealer would call ahead to make sure Gulf Coast had enough pills for his fake customers. Cardinal only stopped shipments to Gulf Coast in October 2011, shortly before the DEA demanded information from the distributor. The next month, Gulf Coast surrendered its license.

Green and Hebble were ultimately convicted in federal court of conspiracy and money-laundering charges.

Cardinal contended that volume of drug sales alone is not an accurate measure of lack of compliance. The company noted that Gulf Coast served a hospital complex and hundreds of physicians.

In 2012, Cardinal settled the administrative case, but no fine has been levied. Negotiations are ongoing, according to a federal prosecutor and the company.

In a statement to The Post, Brett Ludwig, Cardinal’s vice president of public relations, said the company deploys “advanced analytics, technology, and teams of anti-diversion specialists and investigators who are embedded in our supply chain. This ensures that we are as effective and efficient as possible in constantly monitoring, identifying, and eliminating any outside criminal activity.”

At Walgreens, an employee at one of the 13 warehouses the drugstore chain operated in the United States grew suspicious of the large orders being sent to some of its pharmacies, court records show.

Kristine Atwell, who managed distribution of controlled substances for the company’s warehouse in Jupiter, Fla., sent an email on Jan. 10, 2011, to corporate headquarters urging that some of the stores be required to justify their large quantity of orders.

“I ran a query to see how many bottles we have sent to store #3836 and we have shipped them 3271 bottles between 12/1/10 and 1/10/11,” Atwell wrote. [A bottle sent by a wholesaler generally contains 100 doses.] “I don’t know how they can even house this many bottle[s] to be honest. How do we go about checking the validity of these orders?”

Walgreens never checked, the DEA said. Between April 2010 and February 2012, the Jupiter distribution center sent 13.7 million oxycodone doses to six Florida stores, records show — many times the norm, the DEA said.

In March 2011, the situation became so alarming at two Walgreens drugstores in the small town of Oviedo, Fla., that Police Chief Jeffrey Chudnow wrote to the company’s top executives, Alan G. McNally, who was chairman; and Gregory D. Wasson, then the president and chief executive.

Chudnow asked that they prohibit Walgreens pharmacists from filling orders where the quantities of narcotics were split over two prescriptions.

“These types of prescriptions overtly denote misuse and possible street sales of these drugs,” Chudnow wrote. He said he never heard back from the executives.

In 2012, the DEA launched a six-month investigation of Walgreens’s Jupiter facility. The probe found that Walgreens failed to maintain an effective system for detecting suspicious orders or reporting them to the DEA.

Even when suspicious orders were identified, the warehouse often shipped the drugs anyway, without making inquiries, the DEA said in court papers. A company spokesman said Walgreens would have no comment on the case.

Walgreens settled with the DEA in 2013, agreeing to pay an $80 million fine — a record for a diversion case at the time. The company acknowledged that its “suspicious order reporting for distribution to certain pharmacies did not meet the standards identified by DEA.”

In 2013, DEA officials at the agency’s headquarters began requiring a higher burden of proof before investigators in the field could take enforcement action. One case that was underway became entangled in that shift, according to interviews and records.

Beginning in 2011, the DEA had repeatedly warned Miami-Luken, an Ohio-based distributor, about suspicious sales of opioids, according to Jim Geldhof, then the agency’s program manager in Detroit.

“We went to management of the company and told them they have to look at their sales. They are pretty extraordinary,” said Geldhof, who retired in January after more than four decades with the agency. “We spoke to them on multiple occasions, and we were pretty much ignored.”

Yet investigators couldn’t persuade lawyers at DEA headquarters to allow them to take action.

Geldhof said orders to show cause that he requested in 2013 were not issued until November 2015.

“It sat there for two years. I don’t know why there was a delay,” Geldhof said. “We went back and forth. The ball was always moving. We had all of this going on, overdose deaths, what part of this are we not getting them to understand. We said, ‘You tell us what you want and we’ll give it to you.’ ”

Inside Miami-Luken headquarters, employees had also seen troubling signs. Two of them sent word up the chain. A pharmaceutical buyer and a customer-service representative were concerned about large oxycodone orders by a southern Ohio pain clinic.

The warnings reached senior company officials, including then-chief executive Anthony Rattini. But little changed.

Cindy Willet, the senior pharmaceutical buyer, told investigators in 2015 that she eventually “stopped talking to [Rattini] about her concerns because he wasn’t doing anything about it. It was as if it was falling on deaf ears. Tony never stopped an order.”

The pain clinic, Unique Pain Management, was based in Wheelersburg, Ohio, a town of 6,500 at the epicenter of the opioid epidemic. The clinic was run by a father-daughter team of physicians, John and Margy Temponeras. Between December 2009 and June 2010, the clinic’s monthly orders of oxycodone rose from 67,800 doses to 104,400. Miami-Luken did not investigate the surge, according to the DEA.

Despite signs that something was amiss, “Miami-Luken not only continued to ship Dr. [Margy] Temponeras oxycodone, but also shipped increased amounts,” the DEA alleged.

But Margy Temponeras ordered so much OxyContin from Miami-Luken that in August 2010 she drew the attention of Purdue Pharma, the drug’s manufacturer. Purdue cut Miami-Luken’s OxyContin supply by 20 percent, prompting Miami-Luken to halt drug shipments to Temponeras, records show.

Last year, a federal grand jury indicted the Temponerases and a pharmacist on charges that they conspired to illegally sell medication, alleging that at least eight people had died of overdoses connected to the drugs.

Three of those people died while the clinic was receiving drugs from Miami-Luken between November 2008 and August 2010, according to the indictment and DEA records. It is unclear whether Margy Temponeras also purchased drugs from other distributors, or whether any of those who died consumed drugs distributed by Miami-Luken.

The Temponerases are scheduled to stand trial early next year. Their attorneys declined to comment. An attorney for the pharmacist, Raymond Fankell, who is also scheduled to stand trial next year, said Fankell’s involvement was limited to helping Margy Temponeras set up the dispensary in her office and to filling her prescriptions at his drugstore.

During one of their interviews with Rattini, DEA investigators asked how the company documented suspicious orders. Rattini pointed to his compliance officer, who put a finger to his head. “It’s all just up here,” he said.

The agency is now attempting to revoke Miami-Luken’s license. The company has asked for a hearing before a DEA administrative law judge and is battling the DEA in federal court over a subpoena for agency records.

Miami-Luken is one of two distributors identified by The Post whose cases are pending in civil court. Eleven other companies have agreed to settlements, taken corrective steps or given up their licenses to distribute controlled substances, records show.

“We’re taking this to a hearing because we strongly dispute the government’s characterizations,” said Richard H. Blake, an attorney for Miami-Luken.

The company said in court filings that it has purchased software to better identify suspicious orders and added staff to its compliance efforts. Its chairman, Joseph Mastandrea, intends to testify that he removed Rattini from his role supervising compliance “as DEA’s inquiries increased” and that he “realized that Mr. Rattini was not fulfilling the company’s DEA compliance obligations,” according to court filings.

Rattini did not return calls seeking comment. The chairman “will accept responsibility for the company’s past failings,” the court documents state.

Alice Crites contributed to this report.

DRUGS + YOUR KIDS: Learning to Recognize the Signs

As the drug culture changes, parents need to be aware of new products and drug paraphernalia making their way into the hands of teens.

With the school year in full swing, many teens will be tempted by peer pressure to try drugs.

To educate parents, the Department of Public Safety produced: DRUGS + YOUR KIDS: Learning to Recognize the Signs.

· Video:

· Resources: http://dps.mn.gov/divisions/ojp/Pages/drugs-and-your-kids.aspx

“We know that good kids can make poor decisions,” said Department of Public Safety Commissioner Mona Dohman. “Parents can be the biggest influence in guiding their children in the right direction. This video is a resource in helping parents identify the danger signs of possible drug use.”